Costing in Apparel Industry:

What is apparel costing? Why it is important in apparel export business? How do we evaluate the cost? These are the most basic and essential questions to be asked while dealing with the subject of apparel costing. This article details the steps used in the apparel costing process.

Costing is the procedure of determination of production and marketing cost of each product in the line. Costing decisions include every functional division of an industry. Pricing is the process of determination of selling price of the products that are manufactured. It is based on information given in the costing process, the value customers will place on the product, and the competition in the retail market.

Apparel costing is an essential and very important job for apparel merchandiser. Proper costing and negotiation is very important in apparel export business. Costing of the apparel and textile product is a complex problem, it involves numerous number of activities associated with each product. The technique and methods to be used for ascertainment of cost vary from unit to unit depending upon the nature of the industry, type of the product, method of production and the meaning or the sense in which the term cost is used.

Under the circumstances of untainted contest, the supply and demand of the particular product decides the cost/price of the product. In the apparel business sector, product pricing is the responsibility of the manufacturer. An industry’s success is mostly decided by the top management’s perception of the company’s cost structure, the market, pricing options and source of profit.

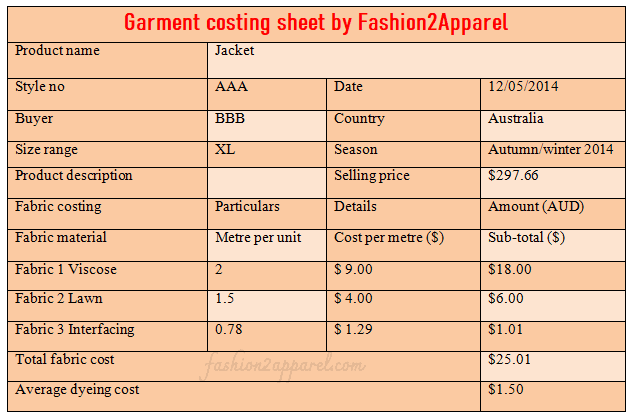

You may also like: What is Garment Costing | Classification of Garment Costing

From the customer’s perspective, the costing of the apparel, which is often termed the ‘price of a apparel’, is the price paid by the customer to own a apparel, which includes the mark-up and margin. The received money is distributed upstream to the supply chain accordingly. The supplier is always willing to reduce the cost of production operations and the whole supply chain in order to impact the profitability positively.

So, practically the price of a garment is always higher than the cost to make the apparel, for the sake of generating profit. The price of a garment is decided based on what revenue a company wants to generate so that after paying expenses a company can earn a reasonable profit. Therefore, it is an elementary requirement to know the cost and factors impacting cost by the manufacturer in order to set a price for the finished apparel.

Factors Affecting Costing:

Since costing impacts directly on profitability, so it is decided carefully considering many factors. If the product is new and first in the market, then the company may achieve a first-mover advantage and set the retail price higher, as opposed to when the product becomes generic the companies will have to reduce the prices. The factors affecting apparel costing are given below.

- Brand recognition: Popular brands can be sold at a higher price due to brand acknowledgement and popularity.

- Nature of apparel: The quality of the merchandise will decide its price and mark-downs.

- Market pressure: Competition in the market is a major driving force behind the price decision. One company out of two, selling the same product will not be able to set the price higher; otherwise they will be out of the market.

- Supply and demand: In the case of low demand and high supply, the prices are to be lowered, and vice versa.

- Other costs: Inventory control, storage cost, pilferage cost, handling cost, alteration cost, delivering cost, etc. will also be an input in deciding the final price of a merchandise.

Components of Apparel Costing:

Normally, the costing is prepared by considering the raw material cost, market demand, operating cost of the industry and forecasted profit of the firm and also considering the expectations of the buyer. The various elements in apparel costing are:

- Fabric

- Trims and accessories

- CMT (cut, make and trim) charges

- Embroidery, appliqué, printing, washing and other value added processes

- Apparel testing

- Logistics and transportation cost

- Profit of the industry

Manufacturing Costs:

The cost accounting structure is normally planned by cost centers; hence, the unit costs for every operation can be estimated. Manufacturing costs comprise all the expenditures that are involved in the production of a final product. These costs are called ‘cost of goods manufactured’ on the income statement. Manufacturing costs are split up into three parts such as raw material cost, direct labor cost and factory overhead.

Raw materials like fabric, sewing thread and trim are called direct variable costs. Direct labor costs in most of the apparel units comprise wages of supervisors and employees who work on an incentive, piece rate or hourly wage basis. Factory overhead includes both variable and nonvariable indirect manufacturing costs. Factory overhead costs are exclusive to each industry; however, they are normally subdivided into (1) indirect labor, (2) factory occupancy costs and (3) other overhead.

Indirect labor includes quality control, service personnel, material handlers, maintenance workers, industrial engineers and security. The job of these persons is vital to efficient production of a product line. Nonvariable factory tenancy costs comprise rent, depreciation, insurance, property taxes and security. Machine parts and repairs and needles are examples of variable factory costs and other overhead costs include machinery and equipment costs, materials management and cost of compliance with regulations.

General working cost/expenses or administrative overhead are indirect costs that incorporate the costs of working the offices and all departments that are not directly concerned with the working of the industry but are important to the operation of the firm. Cost centres such as the accounting department, computer programming, management information systems, secretarial and clerical staff, personnel office, design and merchandising, marketing and sales and management could be considered as part of administrative overhead.

Stages of Costing:

Costing could be carried out at various stages of production, like

- Preliminary or precosting, which is carried out during product development before samples are made.

- Final costing, which is done before the production and price fixing.

- Recosting is done where there is a change in machinery, production processes, materials or apparel components.

- Actual costs are determined during production.

1. Preliminary Costing:

The preliminary costing could be useful for the fashion product manufacturers, who can use it in the development stage to come to a conclusion of whether the fashion design developed by the designers is reproducible and merchantable within the established cost range. Generally, it provides only a rough assessment of costs of manufacturing a specific apparel style based on determination of raw materials cost as well as labor costs of previously produced similar styles. Costing at this early phase of development of product is especially crucial for the manufacturer because of the wider range of ideas the designer could use.

2. Cost Estimating:

Cost estimating, which is done just prior to price setting and production, requires a detailed analysis of apparel components and the specific assembly procedure for each style. Cost estimating determines the expected investment in materials, direct labor and overhead required to produce a single unit of a style. It requires more detail and greater accuracy than preliminary costing. Costing at this stage is based on production samples and standard data.

3. Materials Costing:

Direct costs of fabric, trim and materials for a particular product are based on estimates arrived in the process of sample manufacturing. The initial step in materials costing is to estimate the yardage and materials required for the production of one apparel. Industries with computerized design systems use the data entered for each product to estimate the required fabric yardage for a single apparel. Other direct materials costs like inspecting and shading of fabrics are figured on a per yard basis.

Materials costs are influenced by the rate of utilization and it relies on quantity of material, which is used compared to the total purchased. Poor use can originate from inadequately engineered designs, inconsistent widths, imprudent cutting etc. Many industries have setup benchmarks for fabric utilization.

4. Labor Costing:

The time is the origin of production standards and labor costing and hence it should be determined beforehand if it can be controlled and managed. A production standard reveals the normal time necessary to finish one operation using a particular method that will give predictable quality. Production standards are set up as a measure of productivity of labor and operators under standard conditions. Production standards aid to develop consistency of an operator and to discover the most cost-effective method of production.

Production standards used for estimation of labor costing are generally based on work measurement techniques such as predetermined time (PMTS), standard data and time studies. The time values are normally expressed in terms of standard allowed minutes (SAM). An operation breakdown represents the complete list of all the sequence of operations involved in sewing a specific apparel style. Each operation is recorded in the sequence in which it will be performed along with SAM of every operation. The costing of each operation has to be done independently and could be then converted to dollars per unit. In the apparel industry which gives hourly wages to the operators, production could be based on production standards representing what an operator is anticipated to finish in a definite period of time.

While estimating the direct labor cost, the production standard stipulates the SAM to finish one cycle. The direct labor cost could be estimated by multiplying the quantity or volume that could be produced in one hour and base rate and divided by the actual quantity produced in an hour. The certain percentage of benefits like insurance, sick leave and vacations should be added to the above cost. Machine time is regularly determined separately from handling time which is almost the same when an operation is done. But, the total of time required to complete a line of stitching differs with the seam length, stitches per inch (SPI) and the machine speed. The stitching time may be calculated by taking into account the time variations that may occur with the stitching process.

……………………………..seam length x stitches per inch

SAM for stitching = ————————————————————–

…………………………………..machine speed (rpm)

5. Recosting:

Recosting is determined after apparels are put in the production line and the working patterns are developed. At this stage, alterations could be done to cut down the fabric and sewing time. In a few circumstances, the pattern maker could normally advise an increase in costs in order to improve the quality level.

6. Actual Costs:

Actual costs are estimated by the collection of information from the production department. After a particular style has reached the assembling section, an industrial engineer could face some rates that are too tight and that more time is needed to complete specific operations. If a rate adjustment is required, it will certainly influence the costs.

Elements of Apparel Costing:

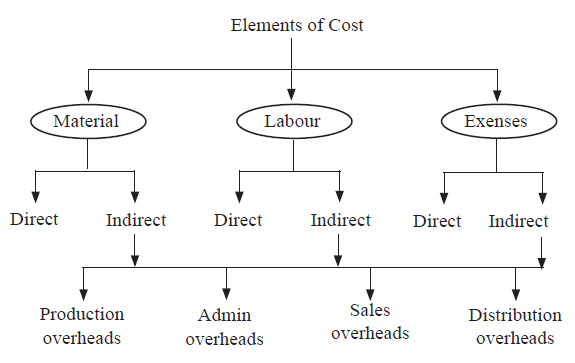

The material, labor and expensesare the fundamental elements of cost. The Figure 1 explains the elements involved in the basic costing process.

A. Material cost:

It is the cost of commodities supplied to an undertaking. This includes, cost of procurements, freight inward, taxes and insurances. These activities are included in material cost because; they are directly attributable for the acquisition of material. Here the material can be specified as any substance from which the item is made. It might be in a crude state as raw material, e.g., fiber for fabric and raw chemicals for dyeing, and so on. Additionally it may be also be in a made state – parts, e.g., buttons, zippers, and so on, materials can be direct and indirect.

1. Direct material:

All materials which become an integral part of the finished product, the cost of which are directly and completely assigned to the specific physical units and charged to the prime cost, are known as direct material. The following are some of the materials that fall under this category:

- Materials which are specifically purchased, acquired or produced for a particular job, order or process.

- Primary packing material (e.g., carton, wrapping, cardboard, etc.).

- Materials passing from one process to another as inputs.

2. Indirect material:

All materials, which cannot be conveniently assigned to specific physical units, are termed as “indirect material”. Such commodities do not form part of the finished products. These items will not be a part of the finished product (physically). Consumables, lubrication oil, stationery and spare parts for the machinery are termed as indirect materials.

B. Labor cost:

Human efforts used for conversion of materials into finished products or doing various jobs in the business are known as labor. Payment made towards the labor is called labor cost. It can also be direct and indirect. The labor cost is defined as

“The cost of remuneration (wages, salary, bonuses, etc.) of an employee of an undertaking” – CIMA

1. Direct labor:

Direct labor cost is the wages, salary, or bonuses, or commission paid to the workers or employees who directly involved in converting the raw material into the finished product. The wages paid to skilled and unskilled workers for manual work or mechanical work for operating machinery, which can be specifically allocated to a particular unit of production, is known as direct wages or direct labor cost.

2. Indirect labor:

Labor employed to perform work which is not a part of manufacturing the end product but only to assist the product or operations are known as indirect labor or those engaged for office work, selling and distribution activities are known as “indirect labor”. The wages paid to such workers are known as “indirect wages”or indirect labor cost.

Example: Salary paid to the driver of the delivery van used for distribution of the product.

C. Expenses:

All expenditures other than material and labor incurred for manufacturing a product or rendering service are termed as “expenses”. Expenses may be direct or indirect.The Expenses may be defined as

“The cost of services provided to an undertaking and notional cost of the use of owned asset” – CIMA.

1. Direct expenses:

Expenses which are specifically incurred and can be directly and wholly allocated to a particular product, job or service are termed as “direct expenses”.

Examples of such expense are: hire charges of special machinery hired for the fob, carriage inward, royalty, cost of special and specific drawings, etc.

2. Indirect expenses:

All expenses excluding indirect material and indirect labor, which cannot be directly and wholly attributed to a particular product, job or service, are termed as “indirect expenses”. Some examples of such expenses are: repairs to machinery, insurance, lighting and rent of the buildings.

***Prime cost

The direct cost of a commodity in terms of the materials and labor involved in its production, excluding fixed costs

Prime cost = Direct material + Direct labor + Direct expenses

Overheads:

Indirect expenses are called overheads, which include material and labor.

Overheads = Indirect material + Indirect labors + Indirect expenses

Overheads are classified as:

- Production or manufacturing overheads – Connected with factory production function like indirect material labor,etc.

- Administrative expenses – Indirect expenditures incurred in general administrative function, they don’t have any direct connection with production or sales activity. For example stationeries used, sweeping brooms, salary of a peon, etc.

- Selling expenses – It is the cost of promoting the sales and retaining the customers. For example advertisement and gifts, etc.

- Distribution expenses – All the expenses incurred from the time of the production completion to the time it reaches its destination. For example packing material, salary of drivers and insurance of the goods.

- Research and development expenses – Any expenses associated with the research and development of a company’s goods or services.

Here,

- Factory cost = Prime cost + Factory overheads

- Cost of production = Factory cost + Office and administrative overheads

- Sales cost = Cost of production + Selling and distribution overheads

- Selling price = Cost of sales + Profit

- Cost/ unit = Selling price / Total production.

Conclusions:

Costing includes all the activities related to purchase of raw materials and accessories, fabrics, processing and finishing of fabrics, sewing and packing of apparels, transport and conveyance, shipping, overheads, banking charges and commissions, etc. There are always fluctuations in the costs of raw materials and accessories; charges of weaving or knitting; processing, finishing, sewing and packing; charges of transportation; and conveyance. Hence, it is essential to have knowledge updates about the latest prices, procedures, quality systems, market prices and availability, transportation and freight charges. The volatile nature and rigorous competition in the global apparel manufacturing industry drive all the companies to minimize their cost by controlling inventory, accurate forecasting and low mark-downs. It must be remembered that the quality depends on price; and price depends on quality. Each product will have different price according to its quality. While the manufacturers and retailers decide the retail price of a apparel, factors such as the average customer’s buying level, quality and quantity and payment terms, should be taken into consideration.

References:

- Apparel Manufacturing Technology By T. Karthik, P. Ganesan and D. Gopalakrishnan

- Apparel Merchandising by R. Rathinamoorthy and R. Surjit

- Garment Manufacturing Technology Edited by Rajkishore Nayak and Rajiv Padhye

- Fashion Marketing Management by A. Arunraj and V. Ramesh Babu

You may also like:

Editor of Fashion2Apparel. She is a fashion designer and ex-lecturer in Fashion Designing. She wants to spread fashion knowledge throughout the world.